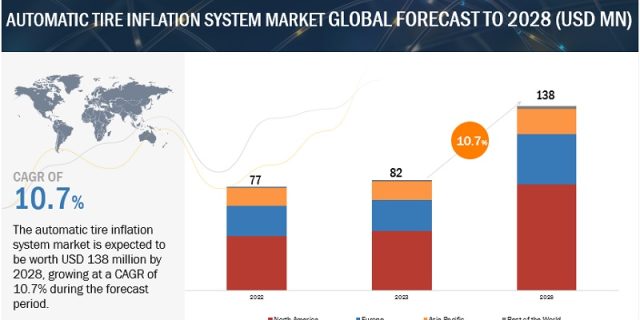

The automatic tire inflation system market size was valued at USD 82 million in 2023 and is expected to reach USD 138 million by 2028, at a CAGR of 10.7% during the forecast period. The increased demand for heavy-duty vehicles and farm tractors would create growth opportunities for the ATIS market. North America and Europe remain the key market for ATIS, though the demand is also increasing in Asia-Pacific.

Increase in tire and drivetrain life

The tire of a vehicle is designed in such a way that it has uniform contact with the road surface across its width and can spread the load it carries across the full width of the tread. This condition only happens when there is even and optimal wear across its tire tread, producing maximum tire life. The over-inflated or under-inflated tires cannot achieve uniform contact of the tread with the road surface and, as a result, generally experience uneven wear and reduced tire life. The tire depends on factors like tire heating, tire sidewalls crack, even out-of-tread segments, and road conditions. Low tire pressure allows side walls to flex excessively; there can create heat. A moderate amount of heat affects the tire tread wear. Even high heat leads to loss of tread segments or even blowout.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=52126096

Rise in the integration of telematics in vehicles

Telematics has merged into the automotive mainstream at a rapid rate. Car telematics help improves driving behavior, road safety, vehicle function monitoring, and preventive maintenance check-up. According to the Global System for Mobile Communications (GSMA), the telematics industry is expected to reach USD 750 billion by 2030. There are two major reasons for the growth of the telematics industry. First is governments’ increasing willingness to mandate telematics services such as emergency-call capabilities, which is already happening in the European Union and Russia — the second is the increasing demand for greater connectivity and intelligence in vehicles.

Major technology giants are partnering with tire inflation system manufacturers to offer telematics features, which improve the driving experience and enhance the comfort and safety of vehicles. In 2019, Phillips Connect Technologies partnered with Pressure Systems International to offer telematics solutions for P.S.I.’s Automatic Tire Inflation System and TireView products. The system proactively pre-checks the status of a transportation asset remotely from any device connected to the internet. It can be helpful for fleet owners to monitor the tire check-up remotely. Pirelli Cyberfleet, for example, includes sensors in the tires (of any type and brand if they are tubeless) that detect the operational parameters and send them to an app for smartphones/tablets.

North America is estimated to be the largest market in 2023

American automotive manufacturers such as EnPro Industries, Goodyear Tire & Rubber Company, Dana Incorporated, IDEX Corporation, The Boler Company, Airgo Systems, Aperia Technologies, Haltec Corporation, Pressure Systems International, Opladen LLC, Trans Technologies Company, Servitech Industries, Vigia, and Velocity offer automatic tire inflation systems.

In 2023, the US was the largest market for automatic tire inflation systems for on-highway vehicles in the region, with a market share of >90%, followed by Canada (~4%) and Mexico (~2%). North America is the largest manufacturer of light commercial vehicles. The region is expected to grow in the automatic tire inflation system market for all vehicle types in the coming years.

Key Market Players

The ATIS market is led by established players, such as Dana Incorporated (US), MICHELIN (France), IDEX Corporation (US), Enpro Industries (US), MERITOR (US), SAF-HOLLAND (Germany), and CLAAS (Germany).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=52126096