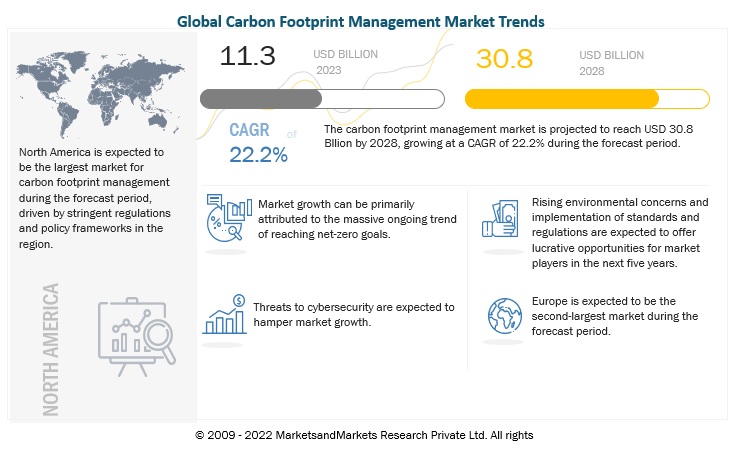

According to a research report “Carbon Footprint Management Market Component (Solutions, and Services), Deployment Mode (On-premises, and Cloud), Organization Size (Corporates/Enterprises, Mid-Tier Enterprises, Small Businesses), Vertical & Region – Global Forecast to 2028″ published by MarketsandMarkets, the global carbon footprint management market is estimated to grow at a CAGR 22.2% between 2023 to 2028 to reach a market size of USD 30.8 billion by 2028, from an estimated USD 11.3 billion in 2023. Implementation of COP27 targets to restrict global warming and an increase in demand for energy consumption by industries are expected to propel the growth of the global carbon footprint management market. Moreover, the swelling demand for energy consumption by industries is also positively impacting the growth of the carbon footprint management market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136375712

Cloud technology is expected to hold the largest share of the Carbon Footprint Management Market, by deployment mode

By deployment mode, the cloud segment of the Carbon Footprint Management Market is expected to be the largest during the forecast period. Businesses are opting for cloud-based solutions as they guarantee safety and security because of these advantages. Cloud deployment mode provides advantages such control over data, lower possibility of data loss, and absence of concerns about regulatory compliance. Moreover, cloud has lower deployment costs, and provides ease of execution, upgrades, and maintenance. All these factors are expected to drive the growth of this segment during the forecast period.

By vertical, the financial services segment is expected to be the fastest growing segment of the Carbon Footprint Management Market during the forecast period

The financial services sector, by vertical, of the Carbon Footprint Management Market is expected to grow at the highest CAGR between 2022 to 2028, owing to the opportunities in sustainable finance products such as sustainability-linked loans, green and transition bonds, sustainable investment funds, and insurance solutions. The banking, and the BFSI (banking, financial services, and insurance) sector as a whole, is IT intensive and the GHG emissions associated with financial institutions’ investing, lending, and underwriting activities are on average over 700 times higher than their direct emissions. Moreover, financial institutions appear to be focused on low-carbon transition opportunities and are rapidly engaging to support and lead the transition to a low-carbon world, driving the fast growth of the segment in the market.

North America is expected to dominate the Carbon Footprint Management Market

North America held a dominant position in the Carbon Footprint Management Market industry in 2022, and is expected to continue to do so throughout the forecast period as a result of the region’s proactive efforts to reduce the effects of climate change. In line with this, the region has set strong NDC targets and enacted binding ESG disclosure regulations. Carbon footprint management solutions are expected to see considerable growth over the next few years.

Ask Sample Pages @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=136375712

To enable an in-depth understanding of the competitive landscape, the report includes profiles of some of the leading players, such as Schneider Electric (France), SAP (Germany), IBM (US), Salesforce (US) and ENGIE (France) along with other prominent vendors of carbon footprint management.