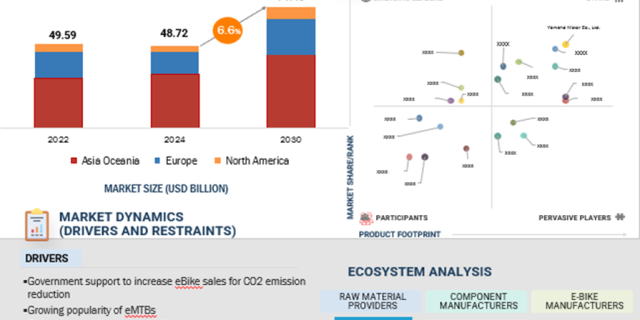

The global e-bike market is projected to grow from USD 54.1 billion in 2025 to USD 87.2 billion by 2032 at a CAGR of 7.0%. The worldwide demand for e-bikes is growing rapidly as customers see them as an eco-friendly solution for commutes. Additionally, their lower total cost of ownership and minimal maintenance make them appealing to budget-conscious consumers. Governments worldwide are actively supporting e-bike adoption through a range of financial incentives, including subsidies, tax benefits, and grant programs. In Europe, consumers can access purchase incentives of up to USD 1,090 (Euro 1000), while in the United States, several states and municipalities have introduced tax rebate schemes to lower upfront costs. Also, the expansion of dedicated cycling infrastructure and charging facilities is making e-bikes a more practical choice for daily transportation.

>250W-<450W battery capacity to hold largest share of e-bike market

E-bikes equipped with battery capacities ranging from >250W to <450W are gaining significant traction due to their optimal balance of range, affordability, and practicality. Offering an effective range of approximately 30 to 70 km under typical usage conditions, these batteries are well-suited for urban commuters and leisure riders who typically travel 15 to 30 km daily. Their relatively low cost, generally between USD 300 and USD 600, makes them attractive in price-sensitive markets such as India, where affordability remains a key purchase consideration. Furthermore, this battery segment aligns with regulatory standards in markets such as the EU and the UK, where a 250W motor limit ensures legal compliance while supporting sufficient power for flat to moderately inclined terrain. Additionally, the manageable weight of 2.5-4 kg enhances portability, appealing to urban riders who need to carry or store bikes, while the growing urban and eco-conscious trend supports their lower energy consumption, aligning with sustainability goals in cities like Delhi. Also, this range pairs well with standard 250-350W motors, providing a versatile option that meets market standards without exceeding regulatory thresholds, further boosting their popularity.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=110827400

OPPORTUNITY: Development of drive motors for enhanced e-bike performance

The ongoing development of advanced drive motor systems creates a significant growth opportunity in the global e-bike market to offer enhanced efficiency, torque, and ride experience. Manufacturers are focusing on compact, high-performance motors that can serve a wide range of users, from daily commuters to off-road cyclists. For instance, Delta Electronics introduced a new mid-drive motor delivering up to 100 Nm of torque, with a compact and energy-efficient design, enabling better integration and smoother performance. At Eurobike 2025, collaboration between Moving Magnet Technologies, Sonceboz, and e-bikeLabs introduced an ultra-compact hub motor offering 70 Nm of torque and regenerative braking, targeting premium urban e-bikes. Valeo’s Cyclee motor system, featuring a 48V mid-drive motor with 130 Nm of torque and an integrated automatic gearbox, combines software features such as smart shifting and anti-theft functions, improving user convenience.

CHALLENGE: High price of e-bikes

E-bikes typically cost between USD?1,500 and?1,700, with high-end models reaching USD?5,000 or more, much higher than the price of traditional bicycles, which average around USD?400. In mature markets like Europe and North America, consumer demand for advanced technology and reliable components drives up prices. The Asian market is highly price-sensitive, making affordability a major barrier to adoption. In China, e-bikes equipped with lead-acid batteries used to cost much less. However, after the government mandated lithium-ion technology in 2019 and introduced a trade-in subsidy program in late 2024, prices for compliant models rose to USD?700–800. This regulatory push helped phase out older lead-acid batteries and less efficient e-bikes, but it also shifted consumer preference toward electric two-wheelers and scooters, which often offer similar performance at comparable costs. Now, emerging US and EU trade tariffs are adding further cost pressure. As a result, manufacturers must innovate to reduce production costs without compromising quality or performance, while governments and OEMs explore incentives and local manufacturing to maintain affordability and competitiveness.

North America to be fastest-growing e-bike market during forecast period.

North America is experiencing significant growth, fueled by supportive government policies, evolving urban mobility trends, and ongoing technological advancements. E-bikes are increasingly viewed as a sustainable and cost-efficient mode of transportation, particularly in densely populated urban areas. Various federal, state, and municipal programs have been implemented to promote adoption through financial incentives, including tax credits, rebates, and public lending schemes. For instance, cities such as Madison (WI) and Chapel Hill (NC) have introduced e-bike lending libraries, while states like California and Colorado offer up to USD 1,000 in rebates for e-bike purchases. In Canada, the expansion of cycling infrastructure and increasing environmental awareness are boosting demand for e-bikes, particularly among urban commuters and first-time users. Additionally, regulatory frameworks in both countries, such as e-bikes, are limited to 750W and 20 mph (32 km/h), making them accessible and street-legal without additional licensing.

The E-bike Market is dominated by a few major players that have a wide regional presence. The major players in the E-bike Market are:

- Pon. Bike (Netherlands)

- Accell Group N.V. (Netherlands)

- Giant Manufacturing Co., Ltd. (Taiwan)

- Yadea Group Holdings, Ltd. (China)

- Merida Bicycle (Taiwan).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=110827400