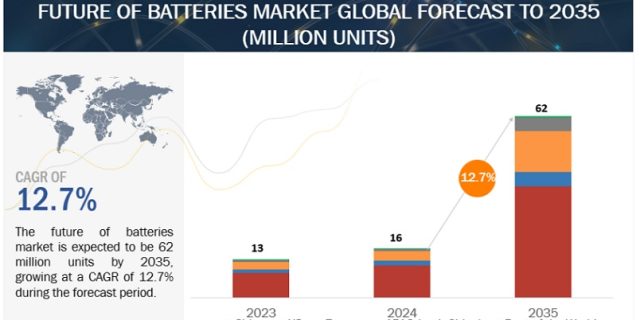

The global future of batteries market is projected to grow from 16 million units in 2024 to 62 million units by 2035, at a CAGR of 12.7%. The growing consciousness among consumers regarding environmental issues and their preference for eco-friendly modes of transportation is propelling the demand for electric vehicles. Increased driving range, quicker charging times, and longer battery life impact consumer choices. Furthermore, improvements in lithium-ion, solid-state, and other developing battery technologies have increased EVs’ efficiency, range, and affordability. Well-known automakers have committed to converting their fleets to electric vehicles and are making significant investments in electric car technologies. This dedication to EVs drives market expansion and battery development.

Market Dynamics:

Driver: Advancements in battery technology

A number of companies have achieved significant advancements in EV battery technology, enabling EVs to become a competitive alternative to traditional automobiles. Continuous advancements in electric vehicle (EV) battery technology aim to increase the range of EVs. Most large EV battery manufacturers innovate in battery chemistry and design to increase EV range and reduce the need for frequent charging. The battery’s cathode chemistry is a major factor in its performance. Three major groups of cathode chemistries are currently in widespread use in the automobile industry: lithium nickel manganese cobalt oxide (NMC), lithium nickel cobalt aluminum oxide (NCA), and lithium iron phosphate (LFP). Because of their higher nickel content, NMC and NCA cathodes are in the most demand out of all of them. They provide high energy density. In addition, since 2020, LFP has gained popularity because of its nickel- and cobalt-free composition and the high cost of battery metals. Unlike hydroxide, which is used for nickel-rich chemistries, LFP uses lithium carbonate.

Market Dynamics:

Driver: Advancements in battery technology

A number of companies have achieved significant advancements in EV battery technology, enabling EVs to become a competitive alternative to traditional automobiles. Continuous advancements in electric vehicle (EV) battery technology aim to increase the range of EVs. Most large EV battery manufacturers innovate in battery chemistry and design to increase EV range and reduce the need for frequent charging. The battery’s cathode chemistry is a major factor in its performance. Three major groups of cathode chemistries are currently in widespread use in the automobile industry: lithium nickel manganese cobalt oxide (NMC), lithium nickel cobalt aluminum oxide (NCA), and lithium iron phosphate (LFP). Because of their higher nickel content, NMC and NCA cathodes are in the most demand out of all of them. They provide high energy density. In addition, since 2020, LFP has gained popularity because of its nickel- and cobalt-free composition and the high cost of battery metals. Unlike hydroxide, which is used for nickel-rich chemistries, LFP uses lithium carbonate.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=243513539

Opportunity: Increase in R&D efforts toward creating more advanced battery chemistries

As the world moves toward adopting clean energy, battery manufacturers are increasing their R&D efforts to develop different battery chemistries. For instance, major players like Amprius Inc. (US) and Nexeon Corporation (UK) are developing silicon anode batteries with enhanced features. These advanced silicon anode batteries are expected to be widely adopted in the coming years. Tesla, Inc. (US) and Panasonic Holdings Corporation (Japan) are also researching and developing silicon anode and lithium-air batteries to power EVs. In June 2023, LG Energy Solution (South Korea) and NOVONIX (Australia) entered into a Joint Research and Development Agreement (JDA) to collaborate on the development of artificial graphite anode material for lithium-ion batteries. VARTA AG (Germany) is also involved in international research projects. Its R&D project, SintBat, aims to develop energy-efficient, cheap, and maintenance-free lithium-ion-based energy storage systems using silicon-based materials and new processing technologies.

As the market for eco-friendly vehicles grows, many manufacturers focus on developing reliable batteries for hybrid and plug-in hybrid EVs, resulting in significant investment in R&D. A growing number of R&D initiatives are expected to offer growth opportunities for EV battery manufacturers during the forecast period.

“Cylindrical segment is expected to grow at the fastest rate during the forecast period.”

The cylindrical segment is projected to register the highest CAGR during the forecast period. Durable and long-lasting are two characteristics of cylindrical batteries. Due to their excellent confinement and effective mechanical resistance against internal and external pressures, cylindrical cells are the least expensive to manufacture compared to alternative EV battery types. Manufacturers are starting to use cylindrical batteries as well. Tesla, for instance, uses cylindrical batteries due to their dependability and robustness. The new generation of cylindrical batteries, like the 4680 format pioneered by Tesla, boasts significant improvements in range and efficiency compared to older models.

“Solid state battery expected to be the next big shift during forecast period.”

Emerging solid-state battery technology has various potential benefits for electric vehicles. Unlike traditional lithium-ion batteries, which utilize liquid electrolytes, they use solid electrolytes. Because solid electrolytes are less likely to experience problems like leaking, overheating, and fire hazards, they are considered safer overall for electric vehicles. Faster charging times could be possible using solid-state batteries as opposed to lithium-ion batteries. Because of their enhanced conductivity and capacity to tolerate higher charging rates, EVs may require fewer charging cycles, saving users time and increasing convenience. For instance, In October 2023, Toyota secured a deal to mass-produce solid-state EV batteries with a 932-mile range. Using materials developed by Idemitsu Kosan will allow Toyota to commercialize these energy-dense batteries by 2028. Solid-state batteries can significantly extend a vehicle’s driving range as well. It is projected that a solid-state battery replacement may quadruple the driving range of the Tesla Roadster. Such benefits will help the solid state battery market grow over the projected period.

“North America to be the prominent growing market for EV batteries during the forecast period.”

The automotive sector in North America is one of the most developed worldwide. Major commercial automakers like Tesla, Proterra, MAN, and NFI Group are based in the region, which makes it well-known for its cutting-edge EV R&D, inventions, and technological advancements. These businesses are investing in constructing and expanding battery production plants in North America. To meet the growing demand for electric vehicles, these facilities produce sophisticated battery technology, including lithium-ion batteries. The US has historically led the way in technology in North America. Leading EV battery suppliers and startups have partnered with OEMs in the North American EV market. For example, GM and LG Chem have partnered.

On the other hand, Stellantis and Samsung SDI are working together to develop EV batteries. Additionally, Ford and SK Innovation are working together. Tesla produces its own EV battery products. These companies are working together to set up production facilities in the United States. Additionally, a number of state and federal laws and programs are promoting the use of EVs and the growth of the EV battery industry. This covers tax breaks for buying electric vehicles, capital expenditures for infrastructure related to charging, and battery research and development financing. In addition, OEMs are focusing more on introducing electric buses, vans, and trucks; this will likely result in a significant growth in the North American EV battery business. Another factor expected to propel expansion in the North American EV battery is the growing need for fleets of zero-emission freight and public transit vehicles.

Key Players

The major players in Future of Batteries market include CATL (China), BYD Company Ltd. (China), LG Energy Solution Ltd. (South Korea), Panasonic Holdings Corporation (Japan), and SK Innovation Co., Ltd. (South Korea). These companies adopted various strategies, such as new product developments and deals, to gain traction in the market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=243513539