Hydrogen is increasingly being viewed as a clean energy carrier with the potential to play an important role in the transition to a low-carbon economy. It can be used to generate energy in fuel cells or as a direct fuel source for heating and transportation.

The rise in hydrogen demand in recent years is attributed to the government’s increased emphasis on establishing hydrogen-based businesses and investment in hydrogen infrastructure. The hydrogen market is expected to benefit significantly from the increased use of low-emission fuels.

The global hydrogen market is valued at USD 242.7 billion in 2023 and is projected to reach USD 410.6 billion by 2030; it is expected to record a CAGR of 7.8% during the forecast period.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=132975342

Players in the Market

- Linde plc (Ireland),

- Air products and Chemicals, Inc. (US),

- Air Liquide (France),

- Worthington Industries (US),

- Cryolor (France),

- Hexagon Purus (Norway),

- NPROXX (Netherlands)

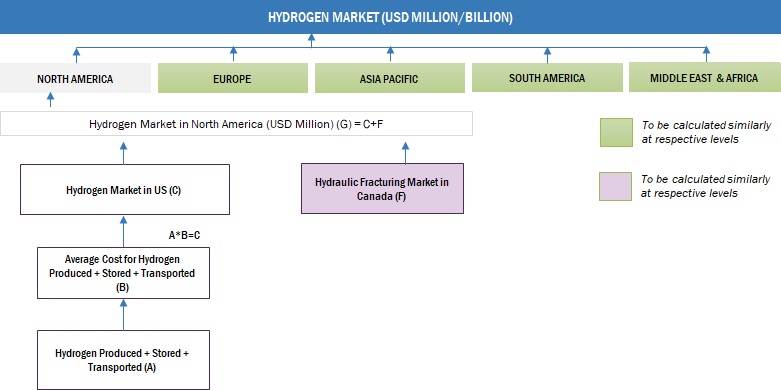

Hydrogen Market Size: Bottom-Up Approach

Hydrogen Market Trends

- Green hydrogen production is predicted to become more cost-effective as technology advances and production scales up.

- Many governments throughout the world have begun to develop laws and incentives to promote the hydrogen economy.

- Hydrogen plays a crucial role in reducing greenhouse gas emissions as part of the worldwide decarbonization effort.

- Green hydrogen generation is gaining popularity, with renewable energy sources such as wind or solar electricity being used to make hydrogen via electrolysis.

- Government Support and Investments: Many governments throughout the world are investing in hydrogen as part of their clean energy initiatives, including financial incentives and funds for R&D.

- Technological developments: Continuous developments in hydrogen production, storage, and transportation are helping to make hydrogen more affordable and efficient.

Key Challenges: –

- Cost: Currently, manufacturing low-carbon hydrogen is more expensive than using traditional fossil fuels.

- Infrastructure for hydrogen generation, storage, transportation, and refueling is still in development.

- Technology Development: Improving efficiency and lowering prices for technologies such as electrolyzers.

Key Stakeholders

- Manufacturers of fuel cell electric vehicles (FCEVs)

- Government organizations

- Owners of hydrogen charging stations

- Developers and operators of hydrogen fuel pumps

- Manufacturers and suppliers of hydrogen generation equipment

- Developers of hydrogen generation infrastructure

- Institutional investors

- Merchant hydrogen producers

- Methanol producers

- Refinery operators

- Research institutes

Ask Sample Pages – https://www.marketsandmarkets.com/requestsampleNew.asp?id=132975342

Objectives of the Study

- To define, describe, segment, and forecast the hydrogen market size, by sector, by application and region, in terms of value and volume

- To define, describe, segment, and forecast the market size, by application, in terms of value

- To forecast the market size across five key regions, namely North America, Europe, Asia Pacific, Middle East & Africa, and South America in terms of value

- To provide detailed information about the key drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To provide information pertaining to the supply chain, trends/disruptions impacting customer business, market map, pricing of hydrogens, and regulatory landscape pertaining to the market

- To strategically analyze the micromarkets with respect to individual growth trends, upcoming expansions, and their contributions to the overall market

- To analyze opportunities for stakeholders in the market and draw a competitive landscape for market players

- To benchmark players within the market using the company evaluation quadrant, which analyzes market players on various parameters within the broad categories of business and product strategies

- To compare key market players with respect to the market share, product specifications, and applications

- To strategically profile key players and comprehensively analyze their market ranking and core competencies.

- To track and analyze competitive developments in the hydrogen market, sales contracts, agreements, investments, expansions, product launches, alliances, mergers, partnerships, joint ventures, collaborations, and acquisitions