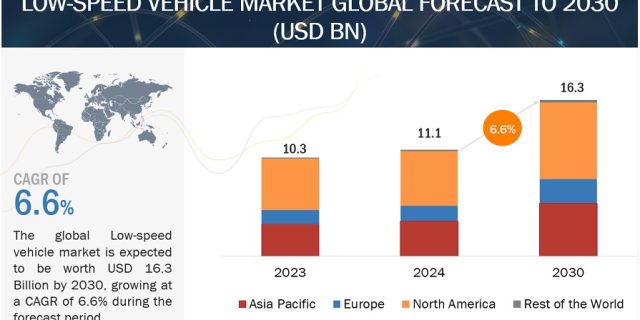

The low-speed vehicle market is projected to grow from USD 11.1 billion in 2024 to USD 16.3 billion by 2030, at a CAGR of 6.6%. Low-speed vehicles (LSVs) are characterized by their four-wheeled structure and a maximum speed typically around 25 mph (40 km/h). These versatile vehicles serve various purposes: industrial vehicles, neighborhood transport, turf utility vehicles, and golf carts. Due to their ease of maneuverability, LSVs are commonly utilized in diverse settings such as golf courses, school campuses, universities, industrial areas, corporate offices, museums, and gated communities among others. Currently, low-speed vehicles are offered in both traditional fuel-powered and electric models. According to MnM Analysis, more than 65% of these vehicles are electrically operated, a trend expected to dominate the global market during the forecast period.

Market Dynamics

DRIVER: Growing popularity for golf

According to the National Golf Foundation, around 26.6 million people in America played golf in 2023, an increase of approximately 1 million golf enthusiasts compared to 2022. Young adults (aged 18–34) are the largest consumer segment for golf, with 6.2 million on-course participants. 3.4 million juniors played golf on a course in 2022. A study by the R&A showed that the number of golf courses worldwide was approximately 38,800 as of July 2022. There has been a significant surge in golf courses in recent years. Most golf courses worldwide are situated in the western hemisphere, with the US at the forefront, boasting over 16,000 courses. However, the US exhibits a relatively low course density of only 0.004 courses per square mile, suggesting a widespread distribution of courses nationwide. Conversely, the UK is the most golf-focused nation among the top 10, showcasing a higher course density of 0.033 per square mile. Specifically, England hosts 2,213 courses across 50,346 square miles, translating to approximately one course every 22.8 square miles.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1965274

OPPORTUNITY: Booming Real Estate and other commercial sectors

The real estate sector is growing globally, with large residential projects seen as the new face of this sector. According to the India Brand Equity Foundation (IBEF), the real estate sector in India is expected to reach USD 1 trillion by 2030, contributing around 13% to the country’s GDP by 2025. Using golf buggies in real estate is an emerging trend driven by the increasing demand for easy mobility solutions within extensive facilities. The distance between two towers or business units in the same locality can be covered by low-speed vehicles. For instance, the Onward series introduced in 2020 by Club Cars offers easy mobility for passengers within such zones.

“Commercial vehicles hold the largest share of the low-speed vehicle market during the forecast period.

Commercial turf utility vehicles are primarily used for transport in hotels, resorts, and college campuses. The demand for these vehicles will likely increase with the growing luxury tourism. According to the latest World Tourism Barometer 2023, international tourism is expected to reach a pre-pandemic level by 2024, with a 2% growth after 2019. An estimated 1.28 billion tourists were recorded worldwide in 2023, a 34% increase compared to the previous year. A steady global travel recovery is expected as countries take measures to boost tourism. For example, in February 2023, the Hong Kong government announced offering 500,000 free round-trip airline tickets. Such initiatives will likely increase the demand for hotels, villas, and resorts and influence the hospitality industry to provide tourists with the best experiences and facilities. Further, developing electric commercial turf utility vehicles for applications such as hotels & resorts, and college campuses would drive the demand for LSVs. Most OEMs who develop electric LSVs for commercial purposes focus on using lithium-ion batteries for the extended driving range. Moreover, Commercial turf utility vehicles are a convenient mode of transportation for sightseeing in the vicinity. They can also be used as shuttles for public transit in IT and theme parks. Further, hotels and resorts are partnering with prominent companies to provide more opportunities for EVs inside their premises. Thus, the growing travel & tourism and hotel & resort industries will drive the demand for commercial utility vehicles.

Lithium-ion batteries are expected to be the most significant and fastest-growing battery type in the electric LSVs.

Lithium-ion batteries dominate the electric LSV market due to their superior features like extended travel range, efficient weight-to-performance ratio, minimal self-discharge, low maintenance, and eco-friendliness. With the decreasing prices of lithium-ion batteries, the OEMs are focusing on developing LSVs fitted with Lithium-ion batteries. Most golf carts and commercial utility vehicles are equipped with lithium-ion batteries to increase the driving range of LSVs. For instance, in 2023, the E-Z-GO launched a low-speed vehicle named Elite Lithium, which was equipped with a battery weighing 46 lbs, much lower than a lead-acid battery, which is around 328 lbs and uses 2.98 kWh of energy. The demand for lithium-ion batteries has increased as they reduce maintenance and vehicle running costs.

North America is estimated to be the dominant low-speed vehicle market.

The North American region has many golf courses, close to around 16,000, or 40% of the total golf courses worldwide. This demand for LSVs in North America can be attributed to the rising adoption of low-speed vehicles in golf courses, hotels, and resorts, coupled with the growing demand for these vehicles for personal mobility. Older citizens in the US prefer low-speed vehicles for short-range commutes. These vehicles are also considered neighborhood vehicles used to commute to gyms, malls, restaurants, schools, and other nearby places.

In North America, prominent industry leaders are dedicated to enhancing their offerings with luxurious features. Companies such as Club Car, Yamaha Motor Co., Ltd, and The Toro Company are investing in research and development to introduce advanced functionalities like connected vehicles and autonomous driving systems. These innovations are tailored for individuals over 40 who rely on these vehicles for daily travels to local destinations like malls, gyms, restaurants, and schools. Additionally, these low-speed vehicles (LSVs) serve purposes beyond personal commutes, being utilized for last-mile delivery services and rentals, facilitating convenient transportation for short distances and leisurely visits to tourist attractions. Thus, the growing demand for golf carts and the development of advanced low-speed vehicles is expected to drive the demand for LSVs in North America.

Key Players

Textron Inc. (US), Deere & Company (US), Yamaha Motor Co., Ltd. (Japan), The Toro Company (US), Kubota Corporation (Japan), Club Car (US), American Landmaster (US), Columbia Vehicle Group Inc. (US), Waev Inc. (US), Suzhou Eagle Electric Vehicle Manufacturing (China).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=1965274