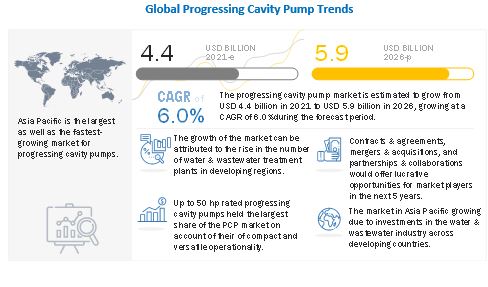

According to the new market research report, the global progressing cavity pump market size is projected to reach USD 5.9 billion by 2026, at a CAGR of 6.0%, from an estimated USD 4.4 billion in 2021. The key drivers for the progressing cavity pump market include use of PCPs in enhanced oil recovery and upstream processes and Intensifying need for water & wastewater management in developed nations.

The up to 500 GPM segment by pumping capacity, is the largest contributor in the progressing cavity pump during the forecast period.

Progressing cavity pumps offering pumping capacity in the range of 0 to 500 GPM capture the largest share of the global PCP market. In 2020, the segment captured more than 65% of the total market owing to the versatility in operation offered by these pumps. In addition to compact size, these pumps require less power-consuming electric or hydraulic motors that are favored across the world for lower operational cost as well as high efficiency. Lower operational cost is also one of the prime factors due to which end-use industries prefer to use these motors over their more powerful counterparts. The food & beverages industry is among the top consumers of these pumps due to the relatively low requirement of flow rate for fluid processing.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=142949269

Power rating, the up to 50 HP segment is expected to be the largest market for progressing cavity pump during the forecast period.

PCPs rated up to 50 hp are predominantly used for abrasion resistance in tough pumping applications. PCPs become mechanical, and their volumetric efficiency rises when the viscosity of the liquid increases and PCPs require limited power supply and flow as compared to other pumps. PCPs rated up to 50 hp are used mainly in the wastewater treatment (for handling polymers, waste, sludge, and flocculants); chemicals (for handling detergents, varnish, paints, inks, and soaps); buildings (for handling cement and bentonite); agro and food (for handling creams, emulsions, wine, and olive oils); food & beverages (for handling dairy product, beverage, convenience food, fruits and vegetables, baked goods, sauce and starch, personal care, meat, fish, and animal food) industries. Progressing cavity pumps with such power rating are not extensively used in the oil & gas industry owing to the fact that the oil & gas industry demands high power rated operational equipment.

The water & wastewater management end user segment is expected to be the largest contributor during the forecast period.

Water & wastewater is the largest end user of PCPs among all the industries. The need to reduce life cycle costs and improve operating margins is anticipated to boost the usage of PCP units in the water & wastewater industry for the processing of polymers, waste, sludge, and flocculants. Intensifying demand for freshwater, handling liquids with higher viscosities, and a clean environment would also propel the need for water and wastewater management in the future, thereby creating opportunities for the usage of PCPs. The demand for these pumps is likely to rise from new plant installations, unit expansions, and unit upgrades. According to the UN, the worlds population will increase from 7.2 billion in 2013 to 8.1 billion by 2025. Hence, factors such as population growth, especially in urban areas, industrial development, increasing emphasis on wastewater treatment, international commitments and targets, and government policies would facilitate the growth of the water & wastewater industry. Moreover, by 2030, the UN plans to achieve universal and equitable access to safe and affordable drinking water and adequate and equitable sanitation for all. This calls for huge investments in the water & wastewater sector. This, in turn, would push the demand for PCPs during the forecast period.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=142949269

Asia Pacific is expected to dominate the global Progressing Cavity Pump market

The Asia Pacific region was the largest market for progressing cavity pumps in 2020 and accounted for a share of 35.7% of the global market. The PCP market in Asia Pacific has been studied for China, Australia, India, and Japan. The other Asian countries considered in the study are Thailand, Malaysia, the Philippines, Singapore, and South Korea. According to the IMF, the economic outlook for Asia Pacific remains strong, and the region continues to be the most dynamic in the global economy. The region has many top global economies, such as China, India, and Japan, and is expected to grow at 5.6% till 2022. The major end users of progressing cavity pumps in the region include water & wastewater treatment, oil & gas, and food & beverages industries. The market in this region will be largely driven by China and India—countries exhibiting fast-paced economic expansion and healthy industrial growth rates. The market in Southeast Asian countries, such as Malaysia and Thailand, is at various stages of development. The government of Malaysia aims to serve clean water to 99% of the population by 2022 from 95.5% in 2015. Such targets are likely to reflect favorably on the PCP market. According to the Indian Ministry of Finance, the country plans to invest USD 646 billion by 2022 in various areas of development. About 70% of the investment would be made in power, roads, and urban infrastructure.

To enable an in-depth understanding of the competitive landscape, the report includes the profiles of some of the top manufacturers in the Progressing Cavity Pump market. These players include Xylem (US), Weir (UK), Sulzer (Switzerland), Roto Pumps (India), EBARA Corporation (Japan), Wilo (Germany), ITT Corporation (US), NETZSCH (Germany), CIRCOR International (US), SEEPEX (Germany).