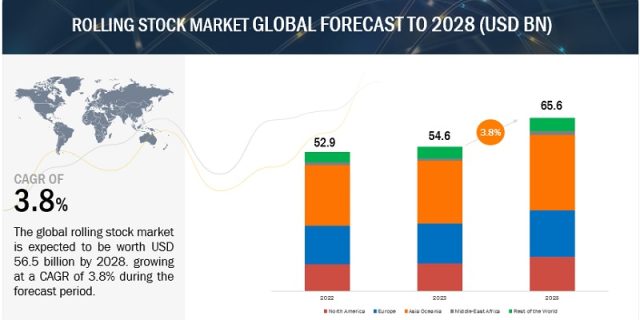

The global rolling stock market size was valued at USD 54.6 billion in 2023 and is expected to reach USD 65.6 billion by 2028, at a CAGR of 3.8% from 2023 to 2028. The global demand for rail vehicles is fuelled by the rising population in urban areas, which puts significant pressure on the existing transportation infrastructure and necessitates expanding the network infrastructure. This has, in turn, increased the demand for rolling stock during the last few years.

Increasing electrification of railway networks

Rising concerns regarding a greener environment have increased the demand for non-polluting and energy-efficient transport systems globally. Additionally, the oil-importing countries are also planning to reduce their oil dependency, thereby looking for an alternative energy source. As a result, most countries prefer electricity as a source of energy for various rolling stocks. This resulted in the increasing electrification of railway networks all over the world. Therefore, the demand for electric locomotives and EMUs is rising at a rapid pace globally. Countries are also replacing their old diesel locomotives and DMUs with electric locomotives and EMUs, respectively.

For instance, in 2021, South Korea announced its plan to completely phase out all diesel-hauled passenger trains in the country and replace them with new electric bullet trains by 2029. In March 2022, the Germany-based industry association VDV announced that the German rail network will be further electrified in the coming years. This could, however, be done at a faster pace by doing away with a preliminary environmental impact assessment and the planning approval requirement. In Germany, currently, around 60% of the railway lines are electrified. The VDV advocates a degree of electrification of 75% of the network. This will provide the necessary boost to the rolling stock industry. Currently, the electrification of railway networks is higher in Russia, Japan, and South Korea. India also has a well-electrified rail network. Currently, three zones of Indian railways have achieved 100% electrification: Kolkata Metro, West Central Railway, and East Coast Railway.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=4380892

Big data applications in rail industry

An improved travel experience, including onboard internet and entertainment, smart tickets, automated fare collection, and door-to-door services, is something that passengers are increasingly looking for. Currently, players in the transportation sector are looking into how to leverage big data collected from passengers’ smart devices to perhaps enhance the economic models of urban rail networks and the caliber of services. Real-time prediction algorithms, scalable data structures, big data communications, and the use of visualization tools are the main goals of using big data and big data analytics.

Application of big data analytics can assist in understanding organizational, technological, and operational problems associated with railway transportation, as well as its effects on the economy. Big data analytics delivers data on the Traffic Management System (TMS), TMS decision-making, remaining life, maintenance-related service, and energy resources. Additionally, it enables rail operators to forecast ridership numbers and improve their product lineup. Big data makes it possible to better analyze the state and prognosticative behavior of rolling stock. Therefore, big data and intelligent rail systems can lower maintenance costs, minimize raks, and increase safety in the railway industry. The Central Organization for Modernization of Workshops (COFMOW), Indian Railways, awarded a contract to Wabtec Corporation in 2022 for its online monitoring of rolling stock (OMRS) project. This makes it possible to find problems with wheels, brakes, bearings, axes, and other parts for all maintenance, speeding up turnaround and improving safety.

Europe is expected to be the second-largest market during the forecast

Europe is estimated to second larget market of the rolling stock in 2023 in terms of value. Germany, the region is a major hub for several renowned OEMs, including Alstom SA (France), Stadler (Switzerland), Talgo (Spain), Siemens AG (Germany), and Construcciones y Auxiliar de Ferrocarriles (Spain). The European rail supply industry is the largest in the world. Most European rails are equipped with high-end technologies, which include wireless radio connections, wireless data transmissions, eco-friendly cars, and features providing comfort. However, the adoption of high-end technology is lower in East European countries compared to West European countries such as the UK, Germany, France, and Spain. This offers rolling stock OEMs opportunities to increase their presence in Eastern Europe. The EU Railway targets to build a 31,000 km high-speed rail track by 2030. Projects such as FP1- MOTIONAL, FP2- R2DATO, and FP3- IAM4RAIL are expected to boost the growth of the European rolling stock market.

Key Players

The major players in global rolling stock market include CRRC Corporation Limited (China), Alstom SA (France), Siemens AG (Germany), Stadler Rail AG (Switzerland), and Wabtec Corporation (US).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=4380892