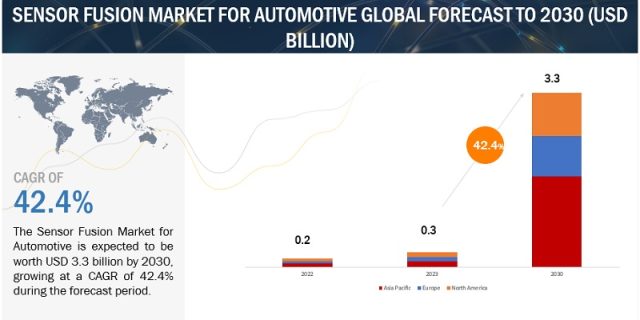

The global Sensor fusion market for automotive is projected to grow from USD 0.3 billion in 2023 to USD 3.3 billion by 2030, registering a CAGR of 42.4%.

The sensor fusion market for automotive is experiencing a remarkable surge in growth, revolutionizing the global automotive industry. Integrating sensors, data, and artificial intelligence has transformed how cars perceive and interact with the environment. This technology is instrumental in reducing accidents, enhancing road safety, and improving traffic management. At present, companies such as Mobileye Global Inc. (Israel), NVIDIA Corporation (US), Qualcomm Incorporated (US), Tesla Inc. (US), and Huawei Technologies, Co., Ltd. (China) are the key players in the sensor fusion market for automotive. Mobileye, as the market leader in ADAS SOCs, leverages its strength in offering an integrated platform that provides clients with comprehensive vision and support across all autonomy levels. It aims to use OTA updates and increase pace of autonomous vehicle deployment. The company also plans to use Multi-SOC approach for Sensor Fusion Applications in L3 and above autonomy systems. Further, Nvidia also stands out as a formidable force in the autonomous driving sector. The company manufacturers its own SOC hardware with Foxconn. The company’s upcoming Drive Thor SOC with 2,000 TOPS capacity is an example of its strong technological advantage over its competitors.

Data fusion is expected to be the largest market by fusion level

Data fusion refers to combining data from multiple sensors to produce a more accurate and reliable representation of the surrounding environment. This is achieved by combining the complementary strengths of different sensors to overcome their individual weaknesses. LeddarTech (Canada), Robert Bosch GmbH (Germany), and BASELABS GmbH (Germany) provide data fusion for autonomous vehicles. Data fusion serves as an indispensable catalyst for the advancement of autonomous driving technologies. These pivotal systems hinge upon the continuous acquisition of data streams from diverse sensors to facilitate real-time decision-making processes. Through the amalgamation of information from multiple sensors, vehicles can construct an exceptionally resilient and redundant perceptual framework, thereby mitigating the potential risks associated with erroneous judgments in pivotal decision-making scenarios. Data fusion augments situational awareness by enabling a more precise and comprehensive discernment of environmental attributes. This kind of sensor fusion happens with basic data generated from individual sensors and requires higher processing. This also increases accuracy, however, also increases cost associated with sensor fusion.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=260287840

Autonomous Driving to be the fastest growing market during the forecast period

Autonomous driving technology represents a shift in the automotive industry. It takes the concept of ADAS to a new level, aspiring to relieve drivers of the burden of manual control. Vehicles equipped with this technology use sensors, high-definition mapping, artificial intelligence, and connectivity to navigate and make decisions. A crucial element of autonomous driving technology is sensor fusion. Modern autonomous vehicles are equipped with a wide array of sensors, including cameras, lidar, radar, and ultrasonic sensors. These sensors continuously scan the vehicle’s surroundings, collecting data about nearby objects, road conditions, and other vehicles. Combining the information from these sensors allows the vehicle to create a detailed, real-time map of its environment, which is essential for safe navigation. Another critical aspect of autonomous driving technology is machine learning and artificial intelligence. The vast amount of data collected by sensors is processed and analysed by sophisticated AI algorithms. These algorithms can recognize and interpret objects in the environment, predict their behaviour, and make real-time decisions based on this information. Machine learning enables the vehicle to learn from past experiences and improve its decision-making capabilities.

Mobileye Global Inc., NVIDIA Corporation, Qualcomm Incorporated, Robert Bosch GmbH, Waymo LLC, and Continental AG provide SOCs and operating systems for autonomous vehicle OEMs. Mobileye focuses on developing advanced operating system features with its EyeQ 5, which provides supercomputer capabilities within a low-power envelope. The EyeQ 5 features generic multithread CPU cores to provide a complete and robust computing platform that ADAS/automated driving applications demand. NVIDIA’s Drive Orin and Thor SOCs are also developed for autonomous driving. They are used by OEMs such as Mercedes Benz for Level 3 Autonomy. Other OEMs are working with component providers to develop autonomous driving systems. In June 2022, the BMW Group and Valeo disclosed their collaboration to develop fully automated parking technologies, specifically focusing on achieving Level 4 automation.

Europe to be the second-fastest growing market during the forecast period

The automotive sector holds a prominent position within the European industrial landscape. As of 2022, the region boasted 322 automobile assembly and production plants, encompassing various vehicle types. Specifically, 127 plants are dedicated to passenger car production, 46 focus on vans, 56 specialize in trucks, 71 are engaged in bus manufacturing, 71 are dedicated to engine production, and 42 are involved in battery manufacturing. Despite the recent global automotive slowdown, the European automotive market has exhibited consistent growth over the past six years. To maintain competitiveness, leading European automotive manufacturers prioritize offering high-performance engines and incorporating advanced safety features. Major players in the European automotive industry, including the Volkswagen Group, Mercedes-Benz, Renault, Hyundai, BMW, Toyota, and Stellantis, are driving demand for sensor fusion technology through the integration of ADAS features in their vehicles. Industry experts anticipate that stringent emission regulations and the pursuit of zero-emission targets in Europe will significantly impact both passenger car and commercial vehicle manufacturers in the forecast period. Consequently, manufacturers are anticipated to increasingly adopt sensor fusion technology in automated vehicles, particularly in the realm of electric vehicles. Notably, Germany, France, and the UK have already granted approval for the operation of autonomous vehicles on roads, with ongoing testing endeavours assessing the viability of these vehicles for road use.

The sensor fusion market for automotive in Europe is anticipated to experience heightened demand, primarily driven by stringent safety regulations. The EU has set a targeted goal to reduce fatalities and injuries by 50% by the year 2030. As part of this strategic initiative, the EU has mandated the inclusion of major safety features, including lane departure warning, automatic emergency braking, and drowsiness and attention detection, in new vehicles. These regulations came into effect in July 2022, reflecting a comprehensive approach to enhance automotive safety. Several European countries, including Germany, France, and the UK, have already granted approval for the utilization of automated vehicles on specific roadways. Notably, Germany took a pioneering step in July 2021 by enacting the Autonomous Driving Act, positioning itself as the first country globally to permit sensor fusion-based level 4 automated vehicles to operate on public roads without the requirement for a human driver as a backup control. In 2015, the French government declared its intention to mandate the installation of automatic emergency braking (AEB) and lane departure warning (LDW) systems in all new heavy trucks, contributing to an increased demand for safety systems within the country. Furthermore, the support from OEMs and the burgeoning presence of numerous startups dedicated to the development of sensor fusion technology are expected to be pivotal factors propelling market growth in the European region.

Key Players

The Sensor fusion market for automotive is dominated by established players such as Mobileye Global Inc. (Israel), NVIDIA Corporation (US), Qualcomm Incorporated (US), Tesla Inc. (US), and Huawei Technologies, Co., Ltd. (China), among others.

Inquire Before Buying @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=260287840