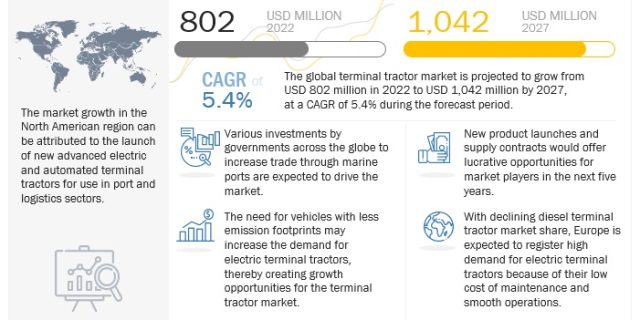

The global terminal tractor market is projected to grow from USD 802 million in 2022 to USD 1,042 million by 2027, at a CAGR of 5.4% during the forecast period. The low maintenance cost of battery electric terminal tractors and increase in the adoption of electric terminal tractors is expected to drive the terminal tractor market.

Due to the regenerative braking feature in the BEV, which partially replaces the typical service brakes, brake lining maintenance for battery electric terminal tractors should be lower than for their diesel equivalents. The majority, if not all, of the maintenance, may be carried out on-site. As we utilize that regen braking, we are getting less wear and tear on the traditional service brake system, which makes those components last longer and reduces the interval times we have on those service brakes.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=153834794

The terminal tractor market for electric and CNG terminal is expected to grow at high CAGR during the forecast period, The increasing cost of crude oil as well as the complexity associated with reducing diesel emissions has fueled the demand for CNG and electric terminal tractors. Battery electric terminal tractors provide a lot of benefits. First, the electrical power required by a battery electric vehicle (BEV) is much less expensive than diesel fuel on an equivalent energy basis. Second, compared to the newest terminal tractors, the cost of maintenance for a BEV is significantly lower. Using battery-powered terminal tractors has several advantages due to which the demand for electric terminal tractors is expected to increase.

North America is expected to lead the terminal tractor market followed by Europe and Asia Pacific. North American countries have a high concentration of logistic and transportation activities and, hence, are expected to witness strong demand for terminal tractors in the coming years. In March 2021, the Maritime Administration of the US Department of Transportation issued a Notice of Funding Opportunity (NOFO), encouraging states and port authorities to apply for USD 230 million in federal grant funding through the Port Infrastructure Development Program (PIDP), for port and intermodal infrastructure-related projects. All such developments are also likely to propel the growth of the regional market during the forecast period.

South Korea in the Asia Pacific is expected to witness significant growth during the forecast period. South Korea is a major producer of electronics, automobiles, telecommunications systems, ships, chemicals, and steel products. Owing to it being home to many businesses, various companies have made investments in the country. The South Korean coast is home to a significant network of ports, including Busan, Gwangyang, Incheon, and Seoul, which helps to explain why foreign trade easily exceeds one billion dollars. Given that South Korea imports items worth more than USD 500 million from all over the world, ocean freight is of the utmost importance to the nation. Marine port trade in the country drives the terminal tractor market in South Korea. The port of Busan, located at the entrance point to northeast Asia, is run by the BPA (Port Authority of Busan), which manages 40% of the nation’s maritime exports and 80% of its container transit. The port has become one of the most significant commercial ports in the world thanks to its extensive and cutting-edge infrastructure. Six container terminals located throughout the North port, the South port, the Gamcheon port, and the Dadapo port give it the ability to accommodate 169 ships at once.

Marine Port is expected to be the largest terminal tractors industry in APAC region. The high marine port processing volume in the country. The growth of the Chinese e-commerce industry and the presence of big brands such as Alibaba and JD.com are expected to support the growth of the market in China. According to the World Shipping Council, of the top 49 container ports, 33 grace the East Asian shore out of which half belong to China. China has been an economic behemoth and the world’s largest manufacturing power in the past decade. Hence, marine port is expected to remain the largest market for terminal tractors over the forecast period in the country.

Key Market Players:

The terminal tractor companies are Kalmar (Finland), Terberg Special Vehicles (Netherlands), Capacity Trucks (US), MAFI Transport-Systeme GmbH (Germany), and TICO Tractors (US).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=153834794

Browse Related Reports:

Farm Equipment Market – Global Forecast to 2028

Container Handling Equipment Market – Global Forecast to 2025

Cargo Handling Equipment Market – Global Forecast to 2025