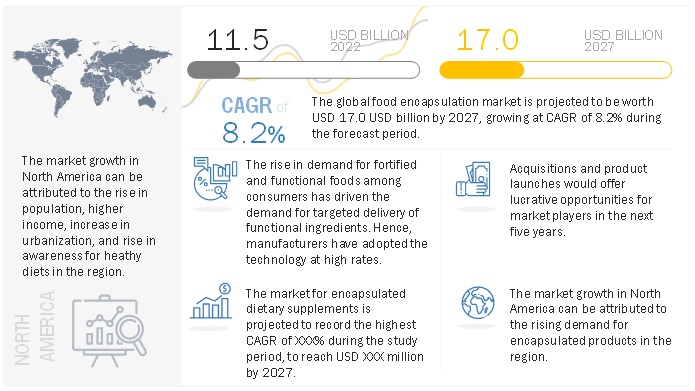

The food encapsulation market size was valued at USD 11.5 billion in 2022; it is projected to grow at a CAGR of 8.2% to reach USD 17.0 billion by 2027. The market for encapsulation is growing globally at a significant pace due to its numerous applications and multiple advantages over other technologies. Some of the major advantages of encapsulation are that it helps provide enhanced stability and bioavailability to the bioactive ingredients, helps increase the shelf life of food products, and maintains the taste and flavor for a longer period of time. Encapsulation is increasingly used in various industrial areas, such as nutraceuticals and food & beverages. The high growth opportunities in emerging regions are attributed to innovations by key players, growing economies, and technological advancements.

The global food encapsulation market is highly competitive, with many global and local market players who have adopted various strategies to expand their global footprint and increase their market share. Agreements & contracts, partnerships, product launches, expansions & investments, and mergers & acquisitions are some of the key strategies adopted by players to achieve growth in the food encapsulation market. According to the International Association of Color Manufacturers, artificial food colors enhance the intensity of natural colors, which results in the virtual colorlessness of natural colors. Thus, favorable government policies for the international trade of confectioneries that use ingredients, such as flavors, sweeteners, and colors, are projected to support the encapsulated artificial food color market for key players. Consumer tastes and preferences are ever-changing with the increasing willingness to try new and appealing products, with flavor variety and other attributes. This will drive demand for various artificial colors from different origins and sources, propelling the food encapsulation market.

Food Encapsulation Market Drivers: Innovative food encapsulation technologies enhance market penetration.

Food encapsulation technology has evolved from being a fundamental preservation technology to a complex food processing technology. This technology enables many properties such as color and taste-masking and controlled release of bioactive ingredients. The evolution of encapsulation technology has happened through many stages. They have been further classified into microencapsulation, microencapsulation, and nanoencapsulation. Food manufacturers are developing newer encapsulation technologies. The aim to maximize and preserve product taste without environmental degradation. The preservation of potency along with health benefits value addition to the product is pushing manufacturers towards adopting food encapsulation.

One of the major applications of food encapsulation is the controlled release of bioactive agents in the food and nutraceutical industries. The increasing complex production of processed foods propels the demand for a controlled release of bioactive compounds. The hydrophobic spheres encapsulated in moisture-sensitive microspheres help improve the shelf-life of foods & beverages. Spheres are homogeneously dispersed in the microsphere matrix and dissolve after encountering saliva or water. This helps in releasing the encapsulated ingredients and prolonging the sensation of flavor and taste since a controlled release of bioactive compounds is a major application in frozen dough, baked foods, confectionery, health bars, processed meats, desserts, nutrition foods, dry beverage powder mixes, and other wellness products.

Food Encapsulation Market Opportunities: Reducing capsule size and increasing bioavailability

According to IUUPAC, nanocapsules size ranges from 1−100 nm range. These nanocapsules are the perfect size for enclosing highly potent bioactive while ensuring targeted delivery. For dietary supplements, the best-suited size is sizes 1, 0, through 00. These capsules can hold up to 290 and 850 mg of the core material. They are ideally suited for powdered and granulated substances. These small capsule sizes are best suited for minerals, water- and fat-soluble vitamins and antioxidants. Hence, it is necessary to focus on reducing the size of the capsule to increase its utility and bioavailability.

Robotic Technology in Food Encapsulation is One of the Major Trends

Robots enhance the process of packaging nutraceutical supplements by being time-efficient and accurate. They increase the shelf life of nutraceutical ingredient products and help them comply with regulatory guidelines by reducing the risk of contamination. Furthermore, the recent increase in demand for nutritional supplements requires large-scale production, increasing the demand for robots to optimize production facilities.

Analyzing machine performance, gathering data, and troubleshooting in advance are the key robotics trends in the nutraceutical ingredients market projected to increase technology adoption in the industry. COBOTs are primarily used in the nutraceutical industry for such applications. According to TransAutomation Technologies, the labor expenditures of three people each day can be offset by a single robot that can perform one function for 24 hours per day. This helped several pharmaceutical and nutritional supplement manufacturers increase productivity, reducing their need for human labor and the challenges and costs that go along with it. Collaborative robots enable humans and robots to work together effectively in open or uncaged environments. Through collaborative robots, a human operator and robot can be engaged together in the same process, or the operator can simultaneously manage other tasks that a person might better solve.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=68

North America dominated the food encapsulation market; it is projected to grow at a CAGR of 7.8% during the forecast period.

The food encapsulation market in North America is influenced by factors like health awareness, the promotion of nutraceuticals and functional foods, and growing expenditure on the prevention of chronic non communicable diseases. Food encapsulation adds value to foods and effectively delivers potent bioactives in isolation as supplements or as value addition in functional foods. The US dominated the market in 2021 and is projected to be the fastest-growing market for food encapsulation in North America. The market in this region is driven by technological advancements in food encapsulation techniques such as liposome compression, inclusion complexes, and centrifugal extrusion, the growing demand for functional and fortified foods that use encapsulated nutrients, and the growing consumption of convenience foods that use encapsulated flavors and colors. Most of the key market players have a presence in the region. These include International Flavors and Fragrances Inc. (US), Sensient Technologies Corporation (US), Balchem Corporation (US), Encapsys LLC (US), Ingredion Incorporated (US), Cargill (US), DuPont (US), Aveka Group (US), and Advanced BioNutrition Corp. (US).

Top Companies in the Food Encapsulation Market

The global food encapsulation market is dominated by top players such as Cargill, Incorporated (US), BASF SE (Germany), Kerry (Ireland), DSM (Netherlands), Ingredion (US), Symrise (Germany), Sensient (Germany), Balchem (US), International Flavors & Fragrances Inc. (US), Firmenich SA (Switzerland), FrieslandCampina (Netherlands), TasteTech (UK), LycoRed Corp (Israel), Ronald T Dodge Company (US), Innov’io (France), Givaudan (Australia), AnaBio Technologies (Ireland), Sphera Encapsulation (Italy), Reed Pacific (Australia), Aveka (US), Advanced Bionutrition Corp (US), Clextral France (US), Vitablend (Netherlands), and Encapsys LLC (US).

BASF SE has a good global presence. The company generates 41% of its revenue from Europe while also targeting other regions. It has been employing effective strategies to gain a considerable market share on the supply side of the food encapsulation market. It has also launched various products specific to local markets in each country. BASF SE continuously invests in R&D; it invested USD 2.38 billion in 2019, enabling the company to provide high-value food-encapsulated products to the food & beverages industry. The company has a strong product portfolio offering products according to the local market demand. The company is expanding its product portfolio and expanding in emerging markets that will fulfil the demand from the food, beverage, and dietary supplement industries in the coming years. It continues to focus on maintaining its market position in the global food encapsulation market through new product launches and geographic expansions in high-growth markets. Owing to huge opportunities in the food encapsulation market, it has expanded its facilities to cater to the growing demand for food encapsulation, thereby enhancing its sales and profitability.

Kerry Group is focused on capitalizing on its nutritional growth platform and expanding its taste and nutrition business globally and regionally to meet customer requirements. It is also focusing on tapping the significant foodservice channel opportunities. Kerry continuously invests efforts into improving its integrated industry-leading technology framework with timely innovation. For premium products, the company has been developing encapsulated flavors in both sweet and savory food products. The company has been focusing on the encapsulation of its flavor ingredients as one of its core processes and plans to expand the application of this technology for other ingredients as well. The company has been investing in its technology & innovation centres across the globe, especially in the UAE, South Africa, and Ireland. It focuses on acquisitions and expansion strategies to support taste strategy, nutrition & wellness platforms, and geographic expansion, especially in developing markets. R&D investments, as it currently has announced to develop an innovation centre in Australia, which will help the company strengthen its presence in Australia. The company is focused on increasing its presence in the US through acquisitions and partnerships. Kerry acquired Niacet (US), which would help the growers gain access to Niacet’s high-quality products and make efficient use of the company’s knowledge of preservation.

Schedule a call with our analysts to discuss your business needs: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=68