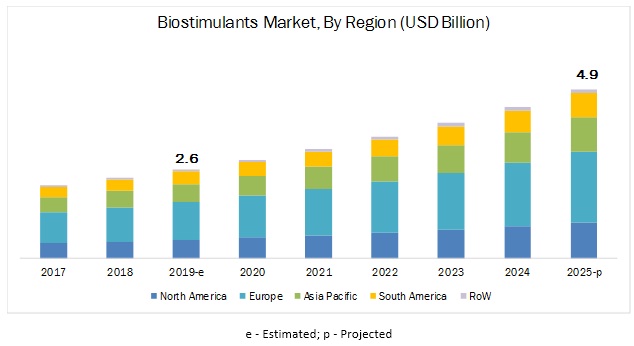

The biostimulants market is estimated to account for USD 2.6 billion in 2019 and is projected to reach USD 4.9 billion by 2025, at a CAGR of 11.24% during the forecast period. The market is primarily driven by the strong market demand for high-value crops across the globe and the increasing need to support crop growth due to abiotic stress, arising from changing climatic conditions. In addition, technological advancements by the key players in most of the regions have led to high demand for biostimulant products.

Report Objectives:

- To determine and forecast the size of the biostimulants market, by active ingredient, crop type, application method, form, and region

- To identify attractive opportunities in the biostimulants market by determining the largest and fastest-growing segments across regions

- To strategically analyze the demand-side factors on the basis of the following:

- Impact of macro- and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions

- To identify the key drivers and restraints that have an impact on the global market

- To strategically profile the key players and comprehensively analyze their market positions in terms of core competencies, along with detailing the competitive landscape for market leaders

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1081

The increasing awareness of nutritional benefits associated with biostimulants and their application on broad-acre crops have widened the scope of growth within the biostimulants market.

The usage of biostimulants has evolved immensely from high-value crops such as fruits & vegetables to broad-acre crops such as cereals, pulses, and fiber crops. It has been observed that biostimulants enhance the uptake of nutrients, develop tolerance to abiotic stresses, and increase the vigor and yield of crops such as wheat, rice, and barley. The immense possibility in the application of biostimulants for these broad-acre crops can lead to the significant growth of this market. Many domestic manufacturers have begun to realize the prospective demand in the coming years, with several launches targeted on crops such as rice, corn, and wheat.

On the basis of form, the liquid segment is projected to witness higher growth in the biostimulants market.

Various factors, such as the type of crop, type of storage available, size of the field, and weather conditions in the region, are attributable to the selection of the form, in which, biostimulants ought to be used. Most biostimulants are available in the liquid form. However, dry soluble formulations are also being made available, owing to their ease of handling and increased shelf life. Suspension concentrate formulations are the most commonly available liquid form of biostimulants. Major companies that manufacture liquid-based biostimulants include Ilsa (acquired by Italy-based Biolchim), UPL (US), Koppert (Netherlands), BioAg Alliance [Monsanto (US), and Novozymes (Denmark).

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=1081

With the introduction of stringent regulations, Europe is estimated to dominate the biostimulants market in 2019.

The biostimulants market in Europe is driven by the adoption of modern agricultural technology such as precision farming, plant biotechnology, and organic-based active ingredients. The increasing awareness of consumers about the benefits of biostimulants is expected to contribute to market growth. Moreover, the European legislation is in the process of recognizing biostimulants as important plant nutrition, and have paved the way toward a regulated environment for these products. Moreover, biostimulant products were initially applied only on high-value crops such as fruits and vegetables in Europe. However, the industrial importance has transformed some broad-acre crops such as corn and wheat into high-value crops, resulting in the increased use of biostimulants for these crops.

This report includes a study of the development strategies of leading companies. The scope of this report includes a detailed study of biostimulant manufacturers such as BASF (Germany), Isagro (Italy), Valagro (Italy), Bayer (Germany), Italpollina (Italy), and UPL (India).