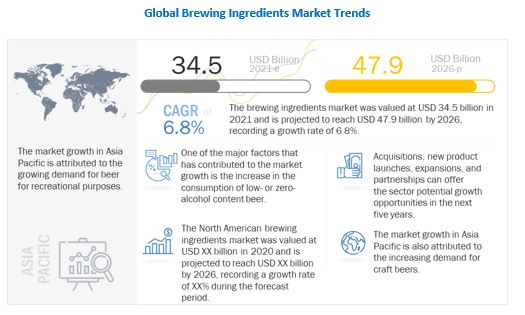

The brewing ingredients market is estimated at USD 34.5 billion in 2021; it is projected to grow at a CAGR of 6.8% to reach USD 47.9 billion by 2026. The rise in demand for beers from all over the globe coupled with increasing consumption of craft beers will drive the market demand and growth of brewing ingredients globally.

Report Objectives:

- To define, segment, and project the global market size for brewing ingredients

- To understand the structure of the brewing ingredients market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=248523644

COVID-19 Impact on the global brewing ingredients Market

The outbreak of COVID-19 has brought serious medical, social, and economic challenges. It is seen that the majority of the companies operating in the manufacturing sector (53%) expect COVID-19 to impact their operations. The grim expectations have become a reality in the sector due to the rise in oil prices and increasing demand & supply bottlenecks which results in a slowdown of expenditures and rising uncertainty in credit markets. Players across the globe in the food & beverage industry have faced a drastic decrease in the consumption of their products. Due to lockdowns in several parts of the world and restrictions on transportation of commodities, companies are also facing disrupted supply chains. The reduced agricultural production interrupting the raw material supply, lack of workers in manufacturing plants, and disturbances in the distribution system have disrupted supply chains.

Opportunity: Introduction of new flavors in beer

The increase in beverage consumption has led to intense competition amongst beer brands, resulting in the introduction of new flavors and increasing beer consumption. There is a growing popularity for craft beers as it offers various flavors besides the regular flavors offered by macro breweries. The introduction of new ingredients and innovative flavors, combining salty, fruity, and tart flavors, by craft beers, has found an increasing appeal among the millennial crowd globally. Some of the macro brewers are also acting on to respond to these changing demands from consumers. For example, Heineken USA, in 2021, launched Dos Equis Lime & Salt variety pack of lager beer. Similarly, Latambarcem Brewery (India), in 2020, launched a new craft beer brand called Maka di that currently serves four brews: Honey Ale, Belgian Tripel, Bavarian Keller, and Belgian Blanche. The introduction of these new flavors is projected to increase the sales and consumption of beer. Thus, this is anticipated to provide ample opportunities to players operating in the global market.

By form, the dry form will drive the demand for brewing ingredients, in terms of value, in 2021

Based on form, the market is categorized as dry and liquid. Dry brewing ingredients such as dry malt extract (DME) are produced the same way as liquid malt extract, except it goes through an additional dehydration step, which reduces the water content down to about 2%. Because of the lower water content, DME tends to have a better shelf life without the darkening issues of light malt extract. It offers more fermentable extract by weight. Thus, less of it is required to achieve the target gravity. Moreover, as a powder, DME is easier to measure in precise increments. With a digital scale, it can be measured out in fractions of an ounce. This makes DME a great choice for priming, supplementing beer recipes, and for making gravity adjustments.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=248523644

Asia Pacific is projected to dominate the majority market share, in the global brewing ingredients market, in terms of value, in 2021

On the basis of the regional area, the market is segmented into North America, Europe, Asia Pacific, South America, and Rest of World (RoW). Due to the increase in population and rise in disposable income, Asia Pacific is projected to account for the largest share during the review period. The drinking preferences of the population in this region are gradually shifting toward alcoholic culture. The large, increasing population and the growing market mean that the demand for brewing ingredients is still promising. Another factor is the densely populated areas that are not completely tapped by beer manufacturing and brewing ingredient companies. Rapid industrialization and urbanization, increase in environmental concerns, rise in disposable income of growing middle class, and rising demand for craft beers are factors consequently fueling the demand for brewing ingredients market in this sector.

This report includes a study on the marketing and development strategies, along with a survey of the product portfolios of the leading companies operating in the brewing ingredients market. It includes the profiles of leading companies, such as Cargill, Incorporated (US), Angel Yeast Co. Ltd. (China), Boortmalt (Belgium), Malteurop Groupe (France), Rahr Corporation (US), Lallemand Inc. (Canada), Viking Malt (Sweden), Lesaffre (France), Maltexco S.A. (Chile), and Simpsons Malt (UK). among others.