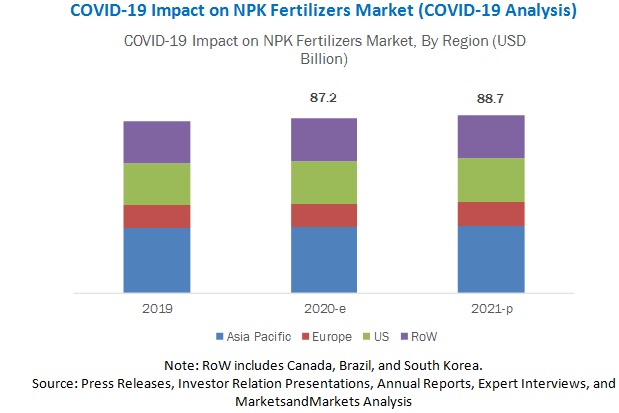

The report “COVID-19 Impact on NPK Fertilizers Market by Nutrient Type (Nitrogenous, Phosphate, and Potash), Crop Type (Cereals & Grains, Oilseeds & Pulses, and Fruits & Vegetables), and Region – Global Forecast to 2021”, Post COVID-19, the NPK fertilizers market size is estimated to grow from USD 87.2 billion in 2020 to USD 88.7 billion by 2021, at a CAGR of 1.8% from 2020 to 2021. The major growth drivers for this market include increasing reliance on fertilizers for crop productivity enhancement and rising crop demand for animal feed production.

Download PDF brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=143983369

By nutrient type, nitrogenous fertilizers segment to dominate the NPK fertilizers market between 2020 and 2025

Nitrogenous fertilizers contain nitrogen in the ammonia, ammonium nitrate, nitrate, and amide forms. Nitrate form is required by most crop plants, while paddy requires nitrogen in ammonical form. Nitrate fertilizers are readily soluble in water and are quickly available for plant uptake. Amide fertilizers include urea, which contains high nitrogen and is used for acidifying soils. Nitrogenous fertilizers are effective in increasing crop productivity, especially in irrigated agriculture, where the soils do not contain enough nitrogen.

Browse in-depth TOC on “COVID-19 Impact on NPK Fertilizers Market“

21 – Tables

18 – Figures

67 – Pages

By crop type, fruits & vegetables segment to witness the highest CAGR during the forecast period.

The fruits & vegetables segment is projected to witness the highest CAGR in the NPK fertilizers market during the forecast period. The harvesting of fruits and vegetables is a highly labor-intensive activity. The COVID-19 outbreak has affected harvesting and production due to labor shortages. For instance, in the US, the H-2A visa program, which brings some 200,000 foreign workers to US farms each year, will not provide access to workers needed to harvest fruits and vegetables in the southern and western states of the US. Transportation bottlenecks are affecting the local supply chain of fruits and vegetables.

Supply chain disruptions have affected the NPK fertilizers market.

Supply chain disruptions in the NPK fertilizers market have affected farmers at the very beginning of the food production process, which begins at the farm level. In some regions, lockdowns have been announced to control the spread of COVID-19, thus hampering the movement of vehicles, containers, and raw materials. Raw material price volatility is also a major challenge faced by the manufacturers of NPK fertilizers due to the COVID-19 pandemic.

Shutdowns resulting in production losses have a substantially negative impact on the NPK fertilizers market.

Countries have entirely shut down various business and trade operations to control the spread of COVID-19. These shutdowns have a direct impact on the fertilizer value chain. Currently, fertilizer manufacturers are relying on emergency stocks of raw materials, which will soon be over if the current scenario continues to persist. The shipping industry has already been reporting slowdowns due to the lockdown and port closures, along with further logistical hurdles, which are projected to disrupt the supply chains in the coming months

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=143983369

APAC expected to lead the NPK fertilizers market during the forecast period

According to FAO, in 2018, the Asia Pacific region was the largest consumer of fertilizers in the world. The share of Asia in world consumption of nitrogen is 62.1%, phosphate 57.6%, and potash 46.4%. Additionally, agricultural technologies are widely accepted and practiced in this region.

Some of the major players in the NPK fertilizers market are Nutrien Ltd. (Canada), Yara International ASA (Norway), and ICL (Israel). As the COVID-19 pandemic spreads across the world, the fertilizer industry’s supply chain focuses on keeping employees and consumers safe while still providing raw materials for fertilizer production.