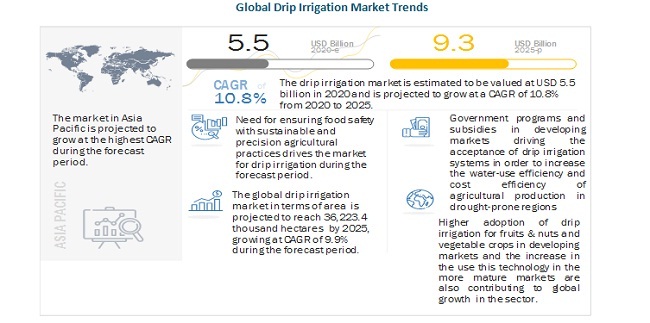

The global drip irrigation market is projected to grow from USD 5.5 billion in 2020 to USD 9.3 billion by 2025, at a CAGR of 10.8%. The rise in the popularity of drip irrigation solutions can be attributed to government initiatives, water conservation activities, enhancement of production, and decrease in production cost. Markets such as China and India are among the key markets targeted by drip irrigation manufacturers and distributors due to the large agriculture sector driven by regional demand and exports that are adopting drip irrigation services in the region.

Driver: Government programs and subsidies driving acceptance of drip irrigation systems

Developing countries such as India and China are among the major countries adopting drip irrigation systems, and the key driver is the support from government agencies and public-private partnerships through prominent industry participants. Government programs such as India’s Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) seeks to extend the coverage of micro-irrigation in the country through subsidies on kits and systems to improve acceptance among farmers. State-sponsored projects are another factor that continues to drive the growth of drip irrigation systems in developing countries.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=217216582

Constraint: High initial cost of large-scale drip irrigation systems

The cost of the initial investment is high, which makes the use of drip irrigations systems uneconomical for low-value crops. The cost of drip irrigation equipment varies with crop type, region, soil, water conditions, fertigation equipment, and filtration equipment. This type of irrigation is considered to be feasible for horticultural crops and cash crops such as grapes, sugarcane, tomatoes, and onions, based on their high economic value. Drip irrigation is expensive due to the requirement of large quantities of piping & filtration equipment.

Ease of installation and higher levels of efficiency drive prospects for inline emitters in the drip irrigation market.

The market is segmented on the basis mode of emitter type into inline and online emitters. Inline emitters are usually present within the laterals with equal spacing. Inline emitters may be flat boat-shaped, cylindrical, or may be attached to the inner wall of the lateral. Inline emitters are usually used for row crops or field crops such as onion, chili, potato, turmeric, vegetables, sugarcane, and cotton. They are prepared from superior-quality linear low-density polyethylene material. They help provide maximum resistance against clogging. Inline emitters are suitable for surface irrigation and subsurface irrigation.

Asia Pacific is projected to dominate the drip irrigation market by 2025

The Asia Pacific drip irrigation market is anticipated to witness significant growth during the forecast period due to the high agricultural production, government initiatives incentivizing the adoption of drip irrigation systems, and increase in irrigable areas in the region which has resulted in water scarcity across multiple countries in the region. Asia Pacific was the largest consumer of drip irrigation and is a key exporter of agricultural products. The region is mainly dominated by large-scale operations, primarily exports, with an organized distribution chain.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=217216582

This report includes a study of the development strategies, along with the product portfolios of leading companies. It also includes the profiles of leading companies such as Jain Irrigation Systems Ltd. (India), Lindsay Corporation (US), The Toro Company (US), Netafim Limited (Israel), Rain Bird Corporation (US), Chinadrip Irrigation Equipment Co. Ltd. (China), Elgo Irrigation Ltd. (Israel), Shanghai Huawei Water Saving Irrigation Corp. (China), Antelco Pty Ltd. (Australia), EPC Industries (India), Microjet Irrigation (South Africa), KSNM Drip (India), Sistema Azud (Italy), Metzer Group (Israel), Grupo Chamartin Chamsa (Italy), and Dripworks Inc. (US).

Recent Developments:

- In June 2020, Lindsay Corporation announced the acquisition of Net Irrigate, LLC (US), an agriculture Internet of Things technology company that provides remote monitoring solutions for irrigation customers. The acquisition would help the company to enhance its irrigation technology offering.

- In May 2020, The Toro Company launched clog-resistant drip tape, Toro Aqua-Traxx Azul drip tape. The drip tape offers a filter inlet design and optimized flow passages that pass through debris to maximize clog resistance and product performance.