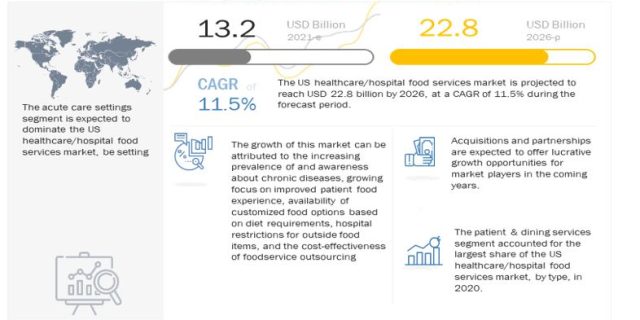

According to the new market research report “US Healthcare/Hospital Food Services Market by Type (Patient Dining (Clinical Nutrition, Regular Diet), Retail Services, Vending, Shops), Settings (Acute Hospitals, ASC, Long-term Care, Nursing and Rehabilitation Centers, Non – acute) – Forecast to 2026″, published by MarketsandMarkets™, the US Healthcare Food Services Market is projected to reach USD 22.8 billion by 2026 from USD 13.2 billion in 2021, at a CAGR of 11.5% during the forecast period.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=170935372

The growth of this US Hospital Food Services Market is mainly attributed to the increasing prevalence of and awareness about chronic diseases, growing focus on improved patient food experience, availability of customized food options based on diet requirements, hospital restrictions for outside food items, and the cost-effectiveness of foodservice outsourcing. On the other hand, the reluctance among OPD patients to pay for food services, pricing challenges, and the shortage of staff are expected to restrain the growth of this market.

The hospital food service industry has been negatively impacted by the pandemic. A reduction in the number of hospitalizations (due to the postponement of elective surgeries in the first 2 quarters of 2020) reduced the overall patient pool, including outpatient visits for consultations. Also, with the increasing requirement of cleanliness and disinfection to reduce the spread of the virus, operational costs increased for hospitals. In this scenario, hospitals adopted creative solutions to address the restrictions and limitations. For instance, hospitals turned to pre-packaged, grab-and-go options throughout the pandemic to sustain their ability to serve customers while decreasing contact. Some facilities began taking advanced to-go orders for team members, patients, and customers to reduce long lines and bottlenecks during peak rush times. Many hospitals have also transformed their self-serve stations into an assembly-line format. Team members handle each step in the process to help consumers customize their meals while minimizing the risk for cross-contamination. Due to the disruptions in the supply chain, many hospitals narrowed their food options and undertook a more need-based approach. This strategy helped hospital foodservice operations sustain retail sales while becoming more efficient in purchasing and inventory.

Food distribution and meal ordering were the two aspects most impacted by COVID-19. Foodservice staff was not allowed into wards with COVID-19 patients to hand out meals. As a result, nursing staff working in these wards were required to perform this task. Hospitals that had been using tablets to take meal orders from patients were forced to change to paper menus that could be discarded after use to minimize the risk of spreading the virus. Some hospitals also created meal-ordering applications for mobile devices, or they would call patients on phones to take their meal orders without any face-to-face interactions. All COVID-19 hospitals were concerned about the safety of kitchen staff during the dishwashing process. To overcome this, some hospitals replaced reusable crockery and cutlery with disposable cutlery and crockery. However, it resulted in increased plastic waste.

Based on type, the US healthcare/hospital food services market is segmented into patient & dining services, retail services, vending & shops (micro-markets), and other services. In 2020, The increasing demand for nutritious food among patients, convenience and comfort provided by room services, availability of customized food options based on diet requirements, and hospital restrictions on outside food items are the major factors driving the growth of this market segment. The retail services segment is estimated to grow at the highest CAGR during the forecast period. The high growth of this segment can be attributed to the increasing availability of various healthier food options with improved quality and taste, ease of accessibility to nutritious meals for hospital staff and visitors, and the growing patient flow in healthcare facilities.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=170935372

Based on type, the patient & dining services market is segmented into regular diets and clinical nutrition. The regular diets segment accounted for the largest share of the patient & dining services market in 2020. The large share of this segment can be attributed to the large number of patients preferring regular diets as they do not require any dietary modifications. The clinical nutrition segment is estimated to grow at the highest CAGR during the forecast period. The high growth of this segment can be attributed to the increasing awareness of the benefits of customized nutrition, increasing availability of customized food products, growing prevalence of chronic and metabolic diseases, and the increasing healthcare spending in the US.

Based on setting, the US hospital food services market is segmented into acute care settings, post-acute care settings, and non-acute care settings. In 2020, the acute care settings segment accounted for the largest share. Also, this segment is estimated to grow at the highest CAGR during the forecast period. The large share and high growth of this segment can be attributed to the high number of acute hospitals, growing number of admissions in acute hospitals, treatment of a large patient pool in acute hospitals, and the growing adoption of foodservice outsourcing by hospitals to improve patient experience and reduce costs.

Based on type, the US healthcare food services market for acute care settings is segmented into acute hospitals, military treatment facilities, ambulatory surgery centers, academic medical centers, and childrens hospitals. The acute hospitals segment accounted for a share of the acute care settings market in 2020. The large share of this segment can be attributed to the high number of acute hospitals and the increasing number of hospital admissions across the US.

Based on type, the US healthcare/hospital food services market for post-acute care settings market is segmented into long-term acute facilities, skilled nursing facilities, and other post-acute care settings (inpatient rehabilitation hospitals and psychiatric hospitals). The skilled nursing facilities segment accounted for the largest share of the post-acute care settings market in 2020. The large share of this segment can be attributed to the high number of skilled nursing facilities and the increasing adoption of food outsourcing services at these facilities.

Based on type, the US healthcare/hospital food services market for non-acute care settings market is segmented into physician offices & clinics and other non-acute care settings (laboratories and pharmacies). The physician offices & clinics segment accounted for a share of the non-acute care settings market in 2020. The large share of this segment can be attributed to the increasing adoption of retail services in these settings.

Major Players:

The prominent players in the US healthcare/hospital food services market are Compass Group plc (UK), Sodexo (France), Aramark (US), Elior Group (France), Healthcare Services Group, Inc. (US), ISS World (US), Culinary Services Group (US), Metz Culinary Management (US), AVI Foodsystems, Inc. (US), Thomas Cuisine (US), Hospital Housekeeping Systems (HHS) (US), Whitsons Culinary Group (US), The Nutrition Group (US), Food Management Group, Inc. (FMG) (US), and Prince Food Systems (US).

Recent Developments

In January 2022, Sodexo announced that it has agreed to acquire Frontline Food Services (d/b/a Accent Food Services), an important player in the fast-growing convenience market in North America. This will broaden the company’s multi-channel offerings, including click n’ collect, take-out, delivery, convenience store concepts, micro-markets, self-service pantries, office refreshments, and smart vending

In December 2021, Sodexo Ventures has further invested in Meican, a digital group catering company in China, to accelerate Sodexo’s food transformation and catering business in China.

In December 2021, Aramark announced a strategic collaboration with Starr Restaurant Organization to optimize the culture of culinary expertise, innovation, and operational excellence at both companies to deliver high-quality hospitality experiences across the US.

In December 2021, Aramark announced the acquisition of the independent foodservice company—Wilson Vale (UK)—to strengthen its portfolio in the UK with a focus on servicing premium B&I and Independent School contracts