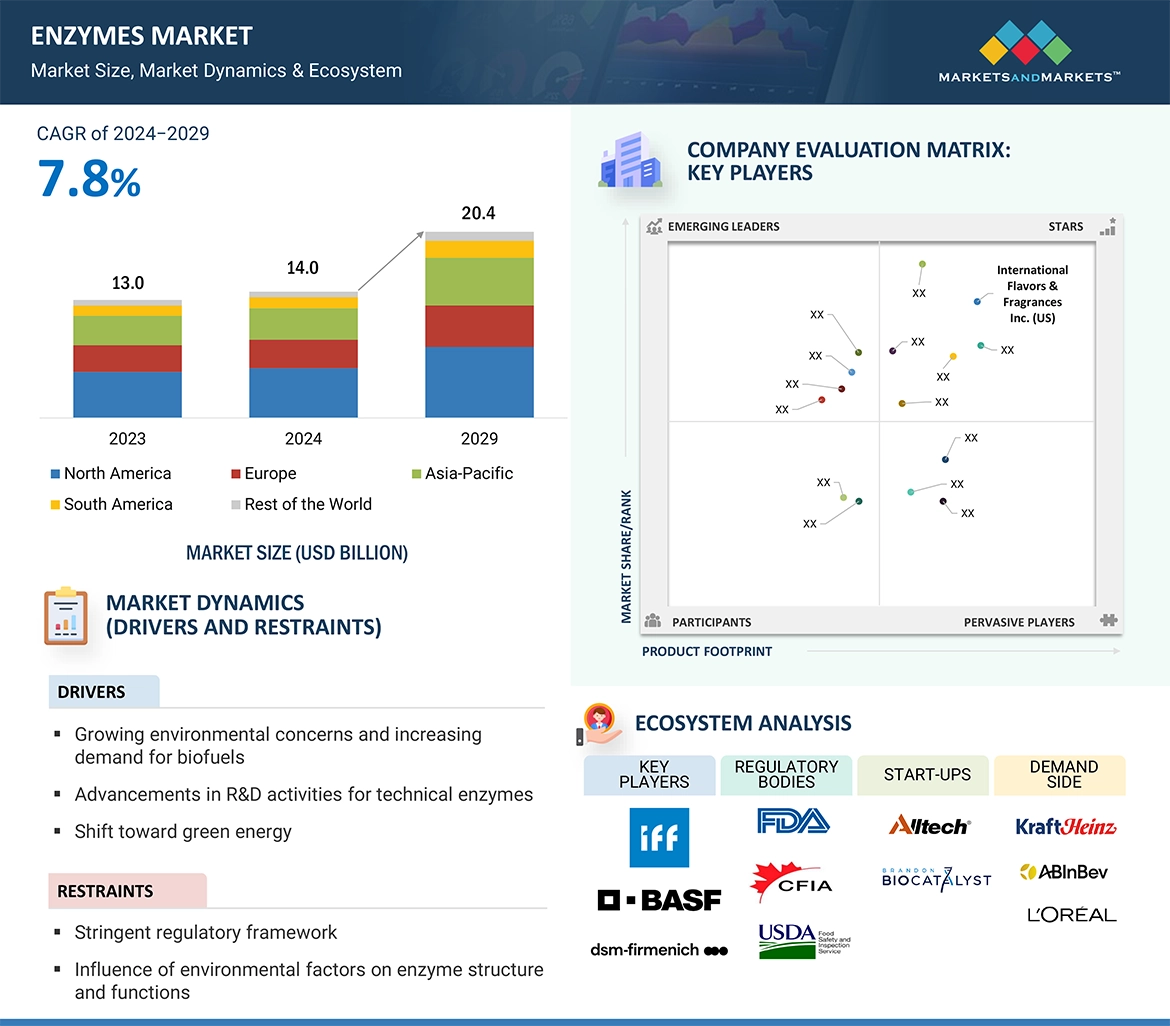

The global enzymes market is valued at USD 14.0 billion in 2024 and is projected to reach USD 20.4 billion by 2029, growing at a CAGR of 7.8%. Market growth is primarily fueled by rising demand for processed foods, as evolving consumer lifestyles and preferences drive the need for enzymes to enhance product quality, texture, and shelf life. Additionally, enzymes are finding broader applications across industries such as pharmaceuticals, biofuels, and textiles, contributing to their expanding adoption.

The market presents attractive opportunities for industry players. For example, in June 2023, Kerry Group plc introduced Biobake EgR, an innovative enzyme solution that reduces egg usage in baking, allowing manufacturers to switch to free-range or organic eggs without increasing costs. In October 2023, Dyadic International, Inc. entered an exclusive agreement with Dapibus to commercialize non-animal dairy enzymes, securing a USD 0.6 million upfront payment, further strengthening its market position.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=46202020

Specialty Enzymes Segment to Dominate

Specialty enzymes are expected to maintain a strong market share, particularly in the pharmaceutical and biotechnology sectors. These enzymes are critical in the production of monoclonal antibodies, gene therapies, and genomic research. For instance, proteinase K is widely used in DNA/RNA extraction, an area experiencing increased demand due to advances in personalized medicine and diagnostics.

Leading companies such as Novozymes A/S and dsm-firmenich continue to invest heavily in developing next-generation enzymes. In May 2023, DSM-Firmenich launched Maxilact Next, a solution that speeds up milk processing by 25%, enhancing the efficiency of lactose-free dairy production without compromising taste. Additionally, regulatory support for biopharmaceuticals and the growing prevalence of chronic diseases further drive demand for specialty enzymes.

Plant-Derived Enzymes Segment Holds Strong Share

Plant-derived enzymes also command a significant market share, supported by increasing demand across food and beverage industries. For example:

- Amylase from barley and wheat is key in brewing, improving starch breakdown and beer quality.

- Pectinase, derived from fruits, enhances juice clarity and yield in the beverage industry.

- Transglutaminase, sourced from plants, improves the texture of plant-based meat alternatives, responding to the surge in vegan and sustainable food products.

Companies like Novozymes A/S are leading innovation, launching solutions such as Saphera Fiber (2020), a plant-based lactase enzyme that boosts fiber content and reduces sugar in dairy products.

Advances in enzyme extraction and formulation technologies are also enhancing the stability and scalability of plant enzymes. With regulatory support for natural and non-GMO ingredients, this segment continues to expand its market footprint.

Asia-Pacific Dominates the Enzymes Market Share

The Asia-Pacific region is forecast to experience the fastest growth in the enzymes market. Key drivers include:

- The region’s biopharmaceutical sector (notably in South Korea and Singapore), where enzymes play a vital role in drug manufacturing and biologics production.

- Rising demand for specialty enzymes in healthcare and diagnostics, fueled by expanding infrastructure and investment.

- Rapid growth of the textile and detergent industries in countries such as Bangladesh and Vietnam, where enzymes improve textile processing and detergent performance.

As consumer preferences evolve and regulatory landscapes shift, the demand for enzymes in Asia-Pacific is set to surge, positioning the region as a vital growth engine for the global market.

Key Questions Addressed by the Enzymes Market Report:

- What is the current size of the global enzymes market?

- What is the projected growth of the enzymes market?

- What are enzymes, and why are they important?

- Which industries use enzymes the most?

- What are the main types of enzymes on the market?

- What are the key drivers for market growth?

- What are the main challenges or restraints in the enzymes market?

- Which regions dominate the enzymes market?

- Who are the major players in the enzymes market?

- What are the upcoming trends in the enzymes market?

- Are there specific regulatory challenges for enzymes?

- What is the outlook for the enzymes market in emerging economies?