The second life EV battery market is estimated at ~25-30 GWH in 2025 and is projected to reach ~330-350 GWH in 2030 at a CAGR of ~65% during the forecast period. Electric vehicles (EVs) have experienced remarkable growth over the past three to four years, driven by strong demand, particularly in the passenger vehicle segment. As global electric passenger & commercial vehicle sales surge to exceed 33-35 million units by 2030, second life applications for EV batteries are increasingly emerging. With Asia Pacific leading in sales share (~68%), followed by Europe and the US, the rapidly expanding EV fleet sets a solid base for repurposing used batteries beyond their initial automotive use. This growing market spans diverse sectors, including industrial, telecom, public utilities, residential storage, and EV charging infrastructure, and is expected to see significant growth by 2030. The expansion of EVs worldwide thus offers strong momentum for developing and commercializing second life EV battery technologies and applications.

Utility-scale grid services hold the largest share of the second-life EV battery market.

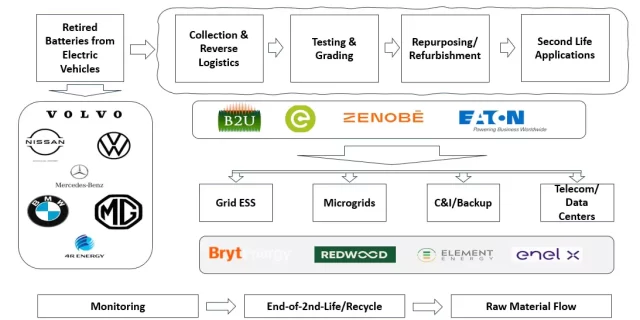

Utility-scale grid applications dominate the actual usage of the second-life EV battery market. These repurposed batteries are attractive for grid applications due to their cost advantage (up to 70% cheaper than new batteries in 2025) and their suitability for less-demanding, lower-cycle stationary uses, such as grid balancing, renewable energy integration, and backup power. Further, these batteries also excel in frequency regulation, peak shaving, and power arbitrage by leveraging their residual capacity for 100-300 cycles annually. Most global players utilize these batteries for energy storage, leveraging renewable energy sources like solar and wind power. Major OEMs such as Volvo, BMW, Nissan (in collaboration with Sumitomo), and Volkswagen are partnering with energy providers and startups to repurpose retired EV batteries for stationary storage projects. For example, Volkswagen Group’s partnership with Audi and the energy company, E.ON, has initiated projects using used EV batteries to stabilize grid loads and manage peak demand.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=40890194

Lithium-ion batteries exhibit the maximum demand in the second-life EV battery market.

Lithium-ion battery technology dominates the market, as more than 95% of electric vehicles, including passenger and commercial vehicles, are installed with this battery technology. Decades of advancements have led to their high energy density, long lifespans, and quick charging & decreasing cost is also expected to make it more affordable and accessible to consumers.

Lithium-ion batteries are advantageous for second-life applications due to their predictable state of health (SoH) retention and established performance benchmarks. Repurposers plan their testing and sorting strategies based on dominant chemistries (LFP and NMC) using tailored diagnostics that assess capacity, internal resistance, cycle count, and safety parameters aligned with each chemistry’s characteristics. LFP batteries often require less intensive safety testing, while NMC batteries demand more rigorous monitoring due to their higher energy density and sensitivity to degradation. These focused testing protocols help maximize utilization, reliability, and safety in various second-life applications such as grid storage and commercial energy solutions. The continued predominance of lithium-ion technology is expected to remain strong, with second-life battery applications playing a vital role in advancing the global energy transition.

North America is expected to be the leading market in terms of the installed capacity of second life EV batteries.

North America leads in installations due to its advanced grid infrastructure and strong policy incentives. These second-life EV batteries are likely to be used at data center stationary energy storage, microgrids for telecommunications and commercial backup, EV charging buffer systems, and domestic solar and grid-support systems. The US is the leading market in the region, with one of the most extensive retired battery stocks in the coming years that can be repurposed for various applications. Projects are consistently scaling, with single sites exceeding 50–60 MWh, and pipelines of new installations in development. Redwood Materials (US) operates the largest microgrid using second-life EV batteries with 63 MWH capacity in Nevada, powering a data center. It also has a pipeline of>1 GWh for various stationary applications. Other regional companies like Moment Energy, B2U Storage Solutions, and Smartville are scaling up production and deploying second-life EV battery systems for energy storage. Additionally, the region is poised to experience an emergence in the second life EV battery storage investments, propelled by ambitious government programs and large-scale industry initiatives. All these factors would lead North America to redirect hundreds of GWh per year of spent EV batteries into second life storage assets, gaining substantial environmental and economic gains by the decade’s end.

Key Players

The major players in the second life EV battery market includeTesla , Volvo , Toyota Motor Corporation , BMW Group , Nissan Motor Corporation , Connected Energy , B2U Storage Solutions , and Rejoule.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=40890194